Effective August 1, 2021, EventTexting will collect and remit sales tax for customers located in jurisdictions where we are obligated to do so. If you are in one of those jurisdictions, you will see the sales tax line item on your invoices moving forward.

Why am I being charged Sales Tax?

EventTexting and other text messaging software providers are legally required to charge sales tax for customers located in jurisdictions that charge sales tax.

In which States do you collect Sales Tax?

As of August 1, 2021, EventTexting will be collecting sales tax in the following states:

- Arizona

- Connecticut

- District of Columbia

- Massachusetts

- Minnesota

- North Carolina

- New York

- Ohio

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

- Wisconsin

Taxation rules and regulations change regularly so EventTexting reserves the right to add or remove jurisdictions without notice to comply with state and local laws.

How does EventTexting calculate how much Sales Tax to charge?

EventTexting uses a third-party application to calculate sales tax based on the rates in your jurisdiction.

We use your billing address or the zip code associated with your credit card as the default address for calculating sales tax. If your physical address is different from your billing address, please contact us at [email protected] and we’ll update our records and calculations accordingly.

Our organization is exempt from Sales Tax. Do we still have to pay Sales Tax?

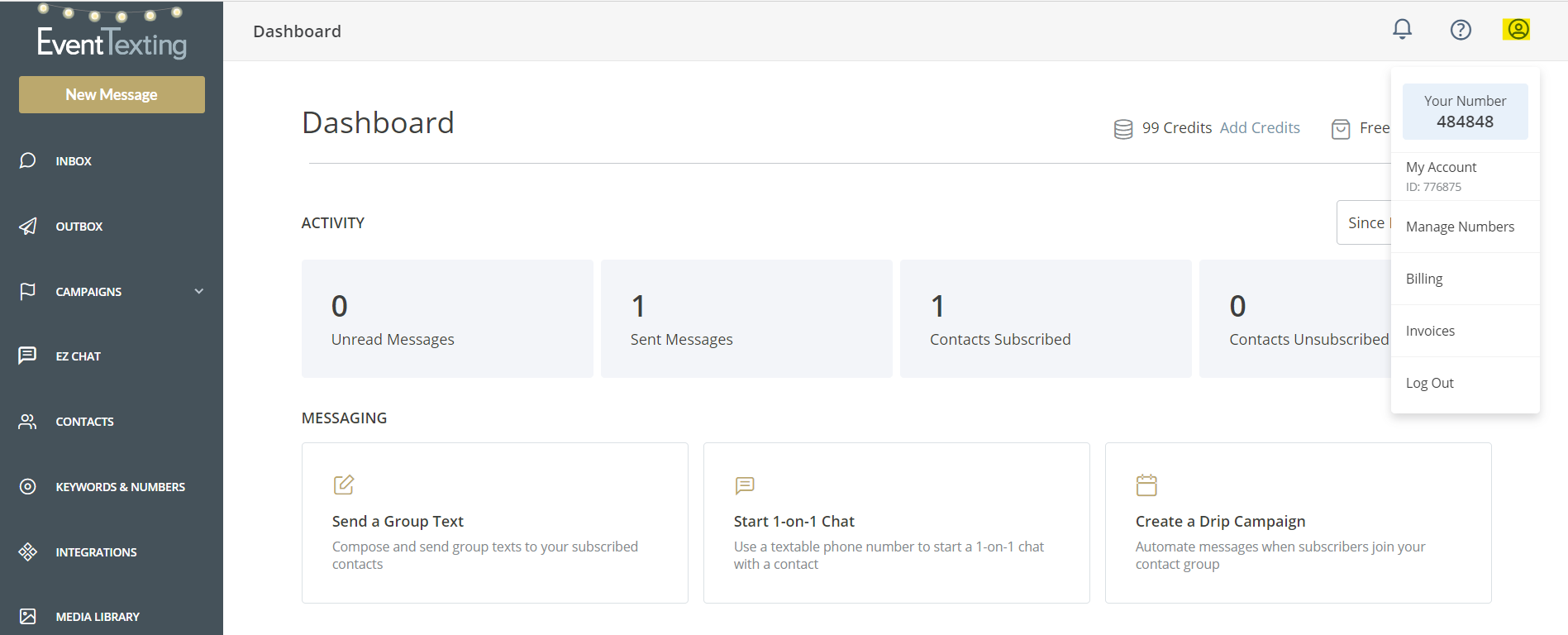

Some organizations, such as non-profits and government agencies, may be exempt from sales tax depending on state tax guidelines. If you believe you are exempt from sales tax, please email us at [email protected] and include your Account Name, Account ID, and tax exemption certificate.

Our team will review your application and update your future invoices accordingly. Please note that you may still be charged sales tax for purchases made prior to your submission and/or when your tax exemption request is under review.

Where can I find my Account Name and Account ID for tax exemption purposes?

In your EventTexting account, select the profile icon in the upper right corner. Hover over My Account where you will see your user ID. Click on My Account for more details.

The name and email address will be located on your profile page.

Will my organization be charged Sales Tax for purchases prior to August 1, 2021

No, EventTexting is not requesting payment of sales tax for any purchases prior to August 1, 2021.

Who can I contact with other questions?

We are happy to help. You can reach us at [email protected].